The different regulations, rules and other parts of the real estate purchasing process can make you crazy. Learning the different tips and tricks for a successful experience in home buying is essential.

When you are planning to purchase a large and costly commercial property, look for a reliable investment partner. When you have a partner who has a good financial standing and reputation, it is much easier to quality for the loan needed to purchase the property. When you have a partner, you can also use his or her income when applying for a loan.

Consider your future family plans when buying a home. If you already have children or might have children later, you should purchase a home with plenty of room for them to grow and play. Safety is an important quality for a home to have as well. Consider the stairs and the swimming pool as risks when looking at a home. By purchasing a home whose previous owners had children, it should be guaranteed to be safe.

If you’ve provided an offer to a seller who didn’t accept it, do not completely give up on the fact that they won’t find a method of making the purchase price affordable for you. The seller might take care of a portion of your closing costs, or make some other improvements to the house for you.

Closing Costs

If you find a fixer-upper that needs improvements you are capable of making, ensure the price reflects the condition of the home. This can be a money-saver in purchasing the home, with the ability to make improvements as time allows. You can not only redesign the home over time, but the modifications you are making build equity you can trade on later. So always consider a home’s potential, rather than just focusing on the negatives that you can see. Your perfect new home could be hidden behind superficial drawbacks like bad paint or cracked paneling.

When you purchase a property, extra funds should always be available for unexpected costs that are bound to arise. The closing costs for the buyer is usually determined by adding the pro-rated taxes with the down payment and bank fees. However, additional expenses are frequently added to the closing costs, including improvement bonds, school taxes, and other location-specific items.

This is a great time to spend some money on real estate. Property values are very low now because of the crash in the housing market. That means that it’s the perfect time to make that move into the affordable home of your dreams. Don’t wait too long because before you know it, the market will quickly rise, and you’ll want to have a nice piece of real estate in your back pocket to be able to reap the benefits.

If a seller doesn’t accept your offer on the home, don’t be surprised if they still manage to make the home affordable for you. They may be willing to cover the price of the closing costs or make some repairs to the home before you move in.

Make a list of questions you want to ask, and take it with you when you interview real estate agents. Ask them for important information. This can include how many houses they have sold in the past twelve months and how many they sold near the location you’re looking at. Your agent should have all of those answers for you!

If you are considering the purchase of a house, check the neighborhood out through the online sex offender registry to ensure there are none located nearby. Almost all states have public sex offender registries, but real estate agents and individual sellers probably won’t highlight the fact that sex offenders live nearby. Protect yourself by researching on your own.

A good tip to use when shopping for a home is to request an itemized checklist from your Realtor. Realtors often have a home-buyer’s checklist that includes everything you need to do or consider when buying home, from figuring out what you want in a house to finalizing a mortgage. You can use the various checklists to make sure you’re ready for every contingent as it comes up.

Never close a deal on a house before you have it inspected by an inspection professional. Homes that require extensive renovation should probably be marked off your list. Not hiring an inspector can ultimately be very expensive, because if the repairs are too extensive, you will need alternate living arrangements while your house is getting repaired.

If you don’t live a cold climate, avoid buying a house with a fireplace. You will find yourself not using these fireplaces and wasting time keeping up with them.

You should understand how mortgages work prior to buying a home. A failure to understand how your monthly payments are structured, especially interest over the life of the loan, may place your home in jeopardy. So take all the time necessary to understand a mortgage and avoid any confusion.

Make sure you get a pre qualification for a home loan when you are house hunting. The logic behind this is that your budget will be determined before you begin searching for your dream home. Securing financing can take a long time, and you don’t want to lose your house waiting for that loan.

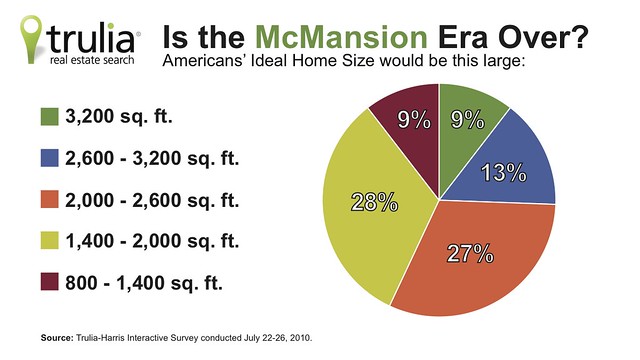

When you really want to buy a home, measure the square footage. Ensure that the listed size matches the public records. The two numbers should be within 100 square feet of each other; if they do not match, either reconsider buying the property, or figure out what is going on.

When you are considering a certain real estate agent, make sure to have plenty of questions planned to address all of your concerns. You should ask questions such as how many homes they sell and whether they are homes that are located in the area you are interested in buying. Any agent worth considering will be able to answer such questions thoroughly and professionally.

If you are purchasing a home, be sure to hire people not related to the seller or agent in anyway. It can be tempting to use the appraisers and house inspectors that the seller has chosen. Nobody likes to spend their money on things that they can get for free. But you need to work with people that you can trust to help you make the right decisions. Spending a little money now can save you a lot of money in the end.

Go for the home of your dreams. Many investors say not to sell your home and buy something larger, while others disagree. Buying the property of your dreams may very well be the best course of action for you now, as home prices are more than likely going to rise.

Look at a sex offender registry online to make sure you are moving into a safe neighborhood before you purchase that dream home. While this information is accessible to the general public, the sellers are not in any way mandated to provide you any details on offenders in the neighborhood. Do your own research!

Prior to signing a lease, speak with the future landlord about the gardening, if you’ve got a garden. Sometimes rentals require that you handle it yourself, or for you to hire a gardener or yard person. It’s also important to find out which utilities costs you will be responsible for.

Before settling on a property to purchase, exercise patience, and be realistic with regard to the various choices available. Sometimes, the house of your dreams might take what seems like forever to find.

Before buying a home, get an inspector to examine it. Buying a house that requires renovations is a decision that can cost you a lot of money if you don’t know what you are getting into. Not hiring an inspector can ultimately be very expensive, because if the repairs are too extensive, you will need alternate living arrangements while your house is getting repaired.

When buying foreclosed properties, hire a good attorney who specializes in real estate. Because complications can come up during a foreclosure process, it is a good call to have your own legal representative to look out for your best interest. Having this person could possibly save you a lot of money over the long term.

Buying home insurance is a necessity for anyone buying a house. It must be done prior to moving in. Waiting risks the insurance not being applicable if, or when, something bad happens, and Mother Nature may be pretty unpredictable.

If you plan on buying a foreclosed house, also plan on doing some repairs. Many of the foreclosed homes that are on the market have been vacant for quite some time. Regular maintenance has more than likely not been done on the home, which means significant repairs should be expected. For example, you may need to install a new HVAC system. The home may also have termites or other pests as well as damage to the walls or floors.

Real Estate

Any appraisers of real estate you’re considering hiring should have five years of experience at minimum. Avoid hiring appraisers that are recommended by the real estate agency. There could be a very real conflict of interest at play. It is also important to ensure your appraiser is properly licensed and certified.

Once you have made the decision to start home shopping, it is important to locate a talented Realtor. You will need to find someone you are able trust. An agent that has a proven track record will lead you in the right direction. Remember to research properly so your best interests are always at the agent’s heart.

Use the tips you’ve just read to jump-start your education in home-buying. You should use these tips to avoid mistakes that can happen to people buying a home. Enjoy the shopping experiences, and your new house!